Azure (AZS AU): SQM The Likely Suitor

Lithium mining play Azure Minerals (AZS AU) went into a trading halt Monday (23 October) "regarding a potential change of control transaction". That halt has been extended to Friday morning.

The obvious suitor is Sociedad Quimica y Minera de C (SQM/B CI) with 19.9%, who approached Azure with a $2.31/share Offer in August but was rejected.

Mark Creasy, a major shareholder in Azure and also a direct stakeholder in Azure's flagship mine, is the key. Should a firm Offer unfold, expect a chunky premium.

Conclusions First

Shares are currently suspended until the commencement of trading on Friday, so there is nothing to be done as yet.

SQM is seeking investments outside of Chile after the government announced in April this year that it would take controlling interest in all projects through a public company that would partner with private mining firms.

SQM's lithium contract in Chile is expected to expire in 2030.

Mark Creasy, who owns a 40% direct stake in Azure's flagship lithium mine, also has a 13.2% stake. Nothing will move forward without his blessing.

And Wilhelm Zours, who helped scupper Genesis Minerals (GMD AU)'s previous tilt for Dacian Gold Ltd (DCN AU), has a non-negligible 10.8% stake.

Plus you can't ignore whether Gina Rinehart gets involved, one way or another.

Pricing is tricky with shares up 350% since the beginning of June.

If taking a stock standard 40% premium to last close - the average premium for Aussie deals discussed on Smartkarma this year - an Offer could be tabled at ~A$3.40/share.

On Azure Minerals

Azure's flagship project is the 60%-held Andover lithium joint venture project, with mining entrepreneur Mark Creasy (“Creasy Group”) owning the remaining 40% of the project.

Andover is a globally significant lithium exploration project and is also host to two nickel-copper-cobalt deposits.

The maiden mineral resource estimate is expected in the 1Q24; and a scoping study in 4Q24.

Azure also holds 70% interests in the Turner River and Coongan Lithium and Gold Projects in the northern and eastern Pilbara, with the Creasy Group holding the balance, and 100%-ownership of the Barton Gold Project.

Barton comprises four granted Exploration Licences and four Exploration Licence Applications that in total cover 888km2 . The Project is situated adjacent to the historical gold mining town of Kookynie, located approximately 40km south of Leonora in the Eastern Goldfields region of Western Australia.

Azure is currently generating no revenue.

Here is the latest ppt presentation and here is the FY23 (June Y/E) accounts.

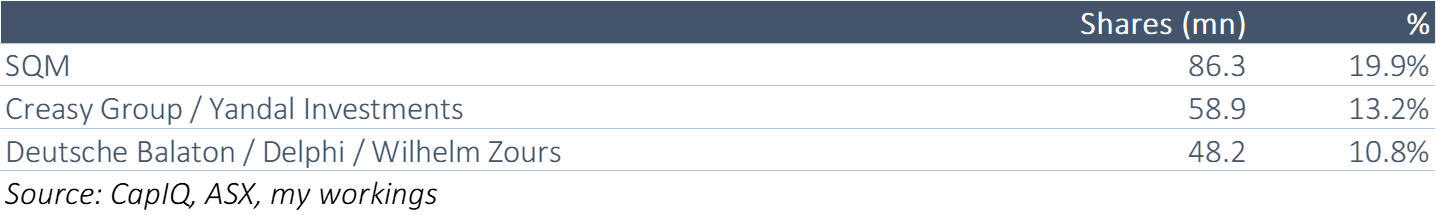

Shareholder Register

SQM became a substantial shareholder on the 10 March this year, with 19.99%.

Mark Creasy's Creasy Group has been on the register since 3Q04.

As above, Creasy hold a 40% stake in the Andover lithium project.

Wilhelm Zours became a substantial shareholder (7.2% at the time) on the 3 March 2018.

Last year, Genesis Minerals (GMD AU) launched an Offer for Dacian Gold Ltd (DCN AU) but was thwarted by Kin Mining Nl (KIN AU) and entities linked to Wilhelm Zours.

Last week, Genesis relaunched another bid (best & final) for Dacian.

Kin ceased to be substantial shareholder on the 17 October.

Reportedly Liontown Resources (LTR AU)-gatecrasher Gina Rinehart and Chris Ellison - the latter has also been active in the lithium space - are also on the register.

Share Price Performance

The share price took off in June of this year.

What Is Fair?

Takeover premiums in Australia in recent years are typically inked at ~35%.

The average this year has been closer to 40%.

In the lithium space, Codelco recently offered Lithium Power International (LPI AU) shareholders A$0.57/share, a whopping 119% premium to last close. The premium was 44.9% for Essential Metals (ESS AU); and 96% for Liontown Resources (LTR AU) (now abandoned).

Given the meteoric rise in Azure's share price from June of this year, it's anyone's guess what the agreed premium will be. Without question, Creasy holds the upper hand in the negotiations.

A 40% premium would translate to ~$3.42/share.

Anything else?

Just 166k shares are short in Azure, as at 19 October.