Estia & Bain: 15th Nov Shareholder Vote

On the 7 August, aged care provider Estia Health (EHE AU) and Bain Capital entered into a Scheme Implementation Agreement at A$3.20/share (less any dividends), a 50% premium to undisturbed

The Scheme Booklet is now out. A shareholder meeting will be held on the 15th of November with implementation expected on the 30th of November.

Estia paid a fully franked dividend of A$0.12/share on the 15th of September. Currently trading tight to the adjusted terms of A$3.08/share. This still needs FIRB approval.

Conclusions First

A five-year high consideration price will get this transaction over the line.

This is trading super tight at 0.6%/5% gross/annualised.

Stay in if already in. But with the risk-free rate >4%, I'd be a buyer (much) lower, not here.

The NEW News

The Scheme Booklet has been lodged with ASIC.

The Scheme Meeting will be held on the 15 October, with implementation (payment) on or before the 30 November.

The Independent Expert (IE) opinion. Kroll's (the IE) report begins on page 108, and runs for a respectable 86 pages, covering the aged care services industry, recent reform (after the Royal Commission), the Covid impact, leading to Estia's background, portfolio, and financial position.

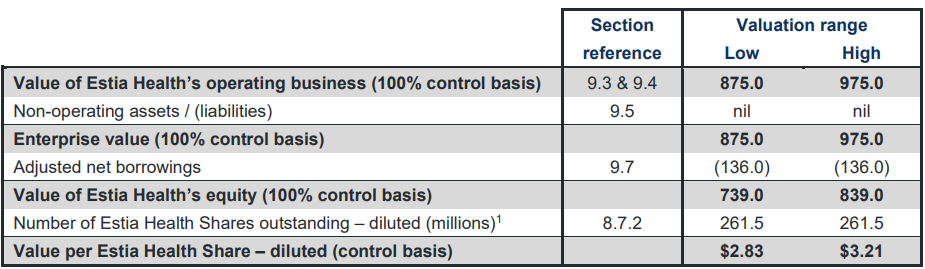

Kroll backed out a fair value range of A$2.83-$3.21/share - see page 111 - with estimates based primarily on DCF. Page 50 onward goes into detail on this valuation approach.

As Estia has not provided earnings guidance for FY24 or beyond, Kroll considered broker consensus forecasts in order to provide an indication of Estia’s expected future performance.

Based on broker consensus, this fair value range backs out an EBITDA multiple for FY24 of 7.7x-8.6x; and 7.9x-8.8x FY23 EBITDA. including the impact from Covid.

Precedents can be found on page184 onward, with a mean EV/EBITDA(LTM) of 10.8x.

Comparable company analysis can be found on page 190 onward.

Kroll reckons the terms are fair and reasonable.

Recap Of The Offer

Estia Health has announced on the 7 August a Scheme Implementation Agreement with Bain Capital at $3.20 cash per share.

This consideration will be reduced by the cash amount of future dividends.

Under the revised terms, Estia was permitted to pay fully franked ordinary dividends of up to $0.12/share.

This will enable eligible shareholders to benefit from franking credits of ~A$0.051/share (1/0.7 x 0.12 - 0.12).

This dividend ex on the 25 August.

Bain had initially pitched a $3.00/share non-binding proposal on the 23 March which was rejected by Estia 12 days later.

Bain returned with a A$3.20/share proposal on the 7 June.

Premium. A$3.20 was a 50% premium to the undisturbed price of A$2.14/share on the 21 March.

Key Conditions. FIRB and stock standard Scheme vote.

Estia's Board unanimously recommends shareholders vote in favour of the Scheme, in the absence of a superior proposal and subject to an Independent Expert concluding that the Scheme is in the best interests of Estia shareholders - which it has.

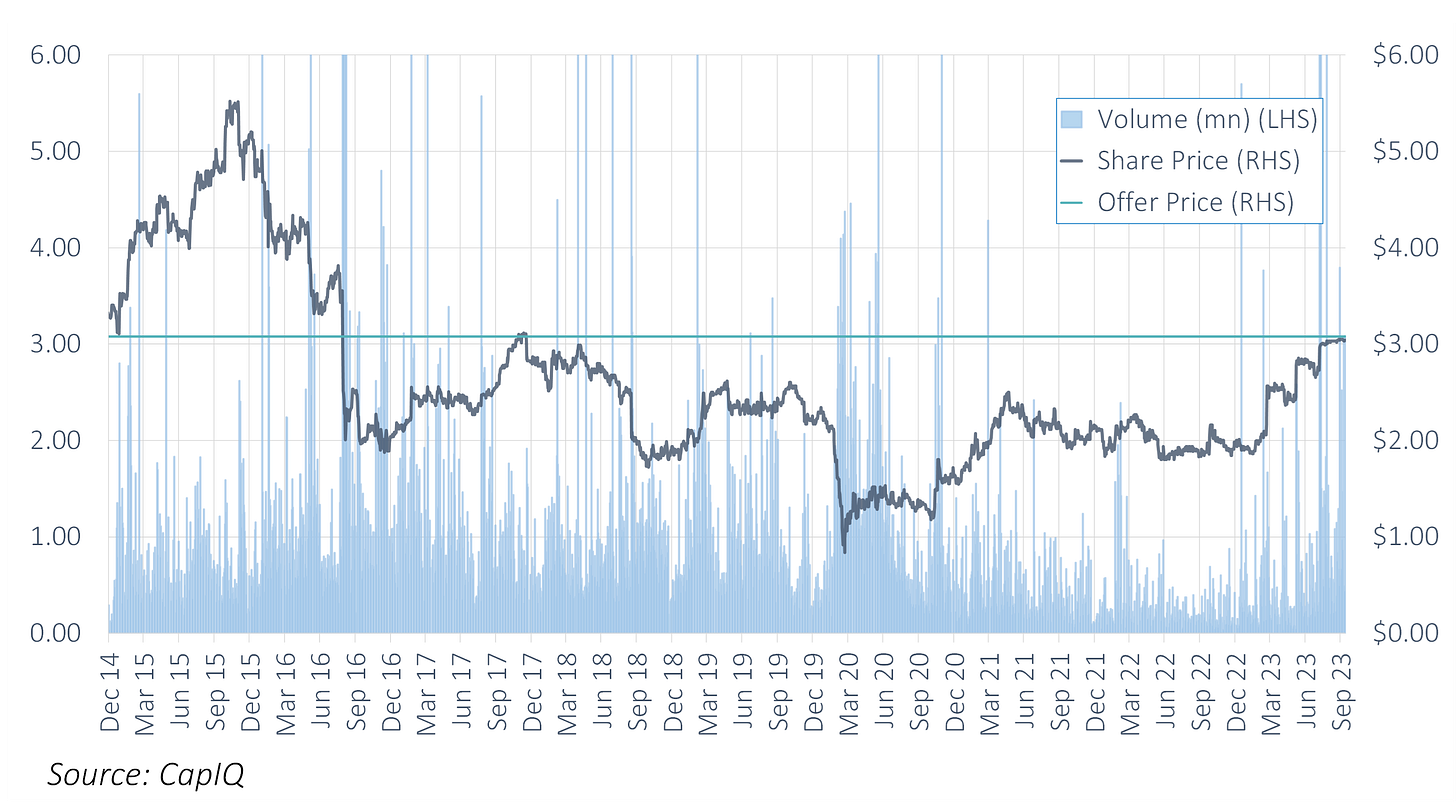

The Offer Price is a five+ year high. I don't expect any pushback from shareholders.

FIRB is still outstanding.

The usual MACs and prescribed occurrences are also present.

On Estia

Estia has 73 aged-care facilities in South Australia, Victoria, New South Wales, and Queensland with a capacity for 6,720 residents.

Shareholder Register

Milford became a substantial shareholder on the 7 September.

Wilson, a long-term shareholder bumped its stake to 8.56% on the 11 November 2022.

Wilson ceased to be a substantial shareholder on the 7 August.

Regal became a substantial shareholder on the 22 March 2023.

Argo ceased to be a substantial shareholder on the 25 August.

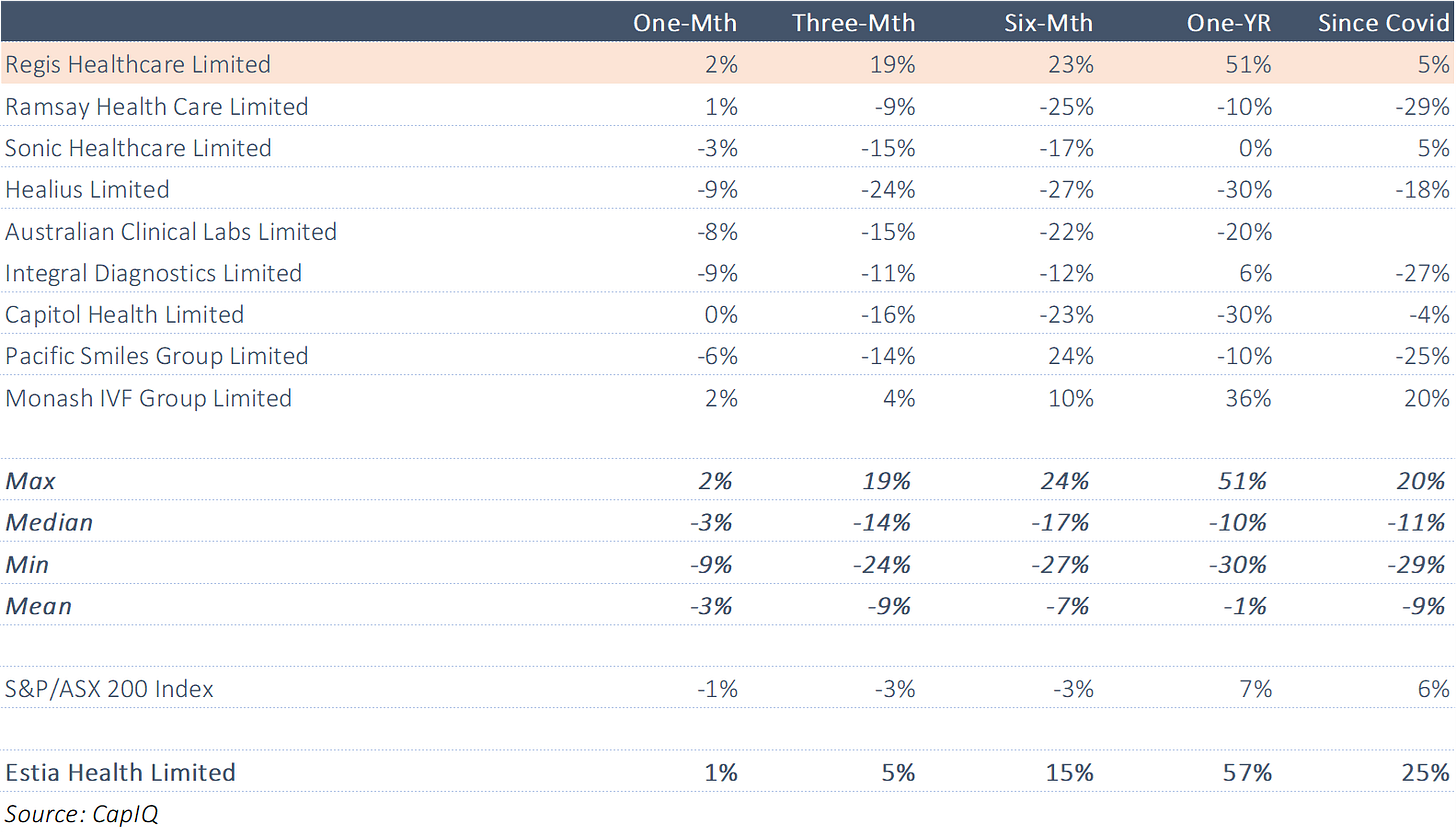

Estia Versus Peers

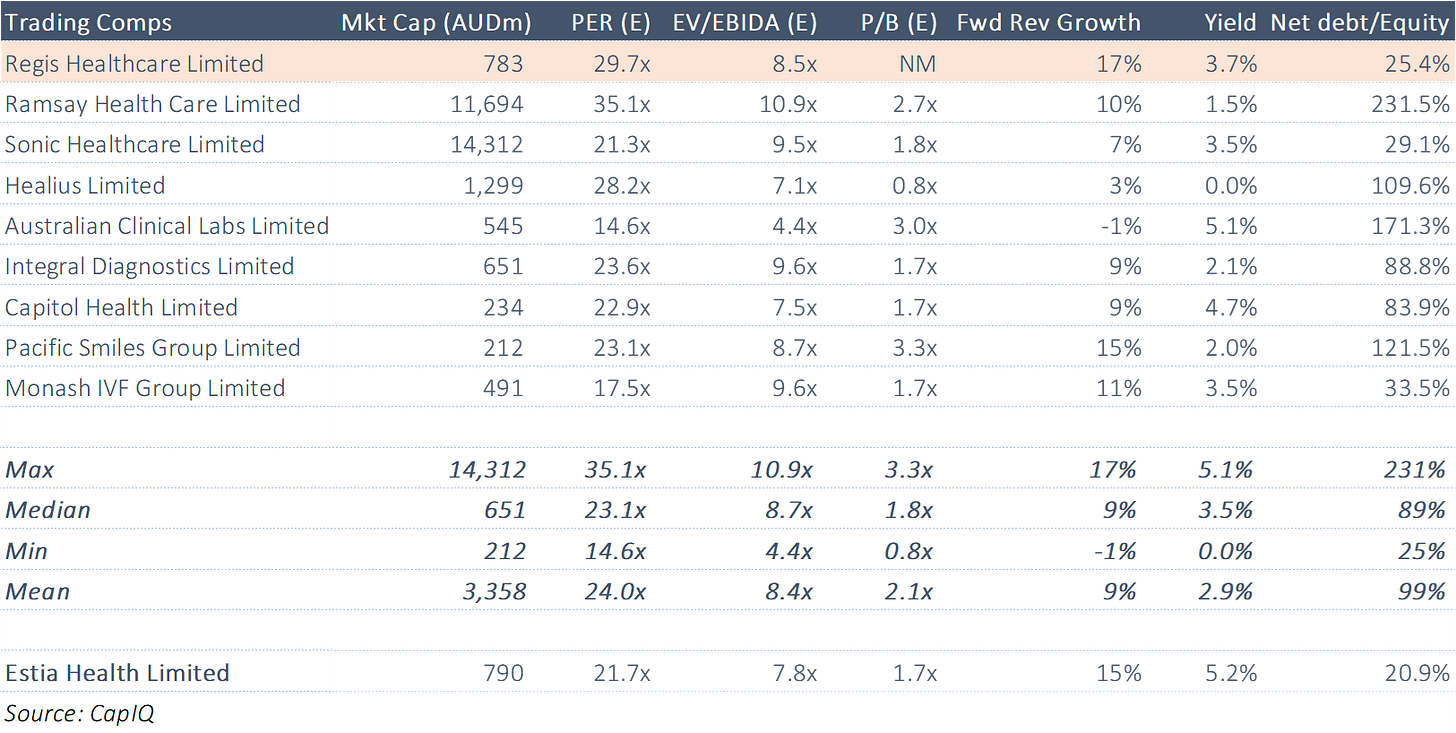

Regis is the only true peer out of this peer basket - peers taken from the IE report, which are the same as those from the IE report for Japara Healthcare (JHC AU).

Estia trades at a discount to Regis on all metrics.

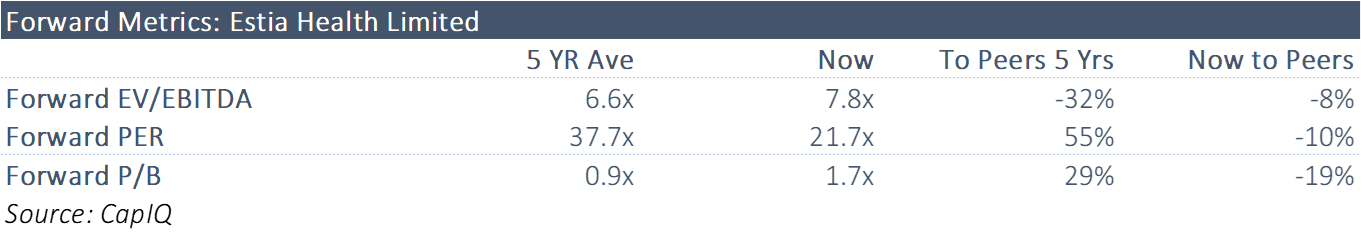

Estia's current forward EV/EBITDA of 7.8x compares to its five-year average of 6.6x.

On a forward EV/EBITDA metric, Estia has traded at a discount of 8% to Regis on average over the past 5 years. It is currently a 9% discount.

Precedents?

In Catholic healthcare provider Calvary's takeover of Japara Healthcare (JHC AU) in 2021, the IE assessed an EV/EBITDA of 7.5x-8.5x EV/EBITDA (on a normalised EBITDA basis) under its 2021 Offer.

This is quite similar to the implied valuation under the Offer for Estia.

Share Price Performance

The share price has largely drifted sideways since 3Q15.

The Offer Price is a five+ year high. Back when Estia was more profitable than now.

Following the initial Offer, Estia is up versus peers (and Regis) on a 12-month basis, and since Covid.