Genex Opens Its Books After Farquhar Bumps

On the 25 July, renewable energy play Genex Power Ltd (GNX AU) announced a non-binding indicative proposal from Atlassian's Scott Farquhar and Stonepeak, by way of a Scheme, at A$0.23/share.

Genex subsequently rejected the proposal less than a week later on the grounds the Offer undervalued the company.

Farquhar, via Skip Essential Infrastructure Fund, and Stonepeak have increased their non-binding proposal to A$0.25/share. Genex has now provided confirmatory due diligence.

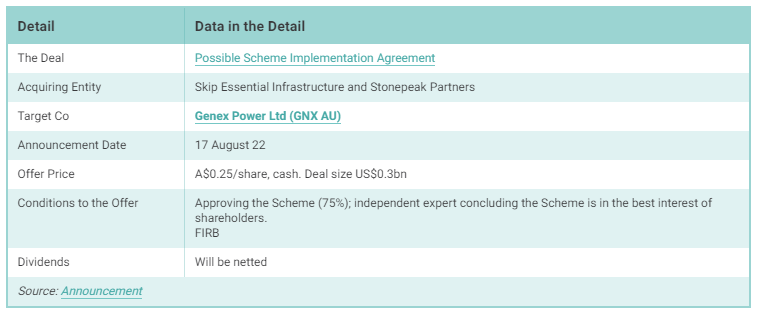

The Offer

Genex has announced that:

it has received a revised conditional, non-binding, indicative proposal from the Consortium to acquire all of the Genex Shares on issue for A$0.250 in cash per Genex Share by way of a scheme of arrangement

The Indicative Proposal is subject to several conditions including:

completion of due diligence to the satisfaction of the Consortium;

Genex's board unanimously recommending the proposal;

and the parties entering into a mutually acceptable scheme implementation agreement;

FIRB approval.

Due Diligence. Genex has provided the Consortium with "the opportunity to conduct confirmatory due diligence in order to assist the Consortium to provide a binding proposal to the Board. The provision of due diligence will be on a non-exclusive basis".

Dividends? Under the terms of the Indicative Proposal, Genex is not permitted to pay any dividends or other distributions.

If any dividends or distributions are paid, the Consortium reserves the right to deduct such amounts from the price payable under the Proposal.

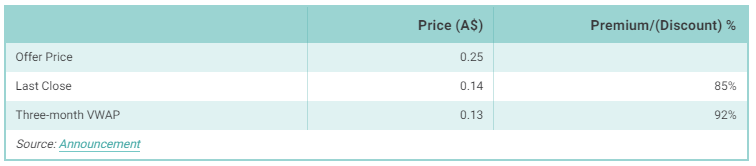

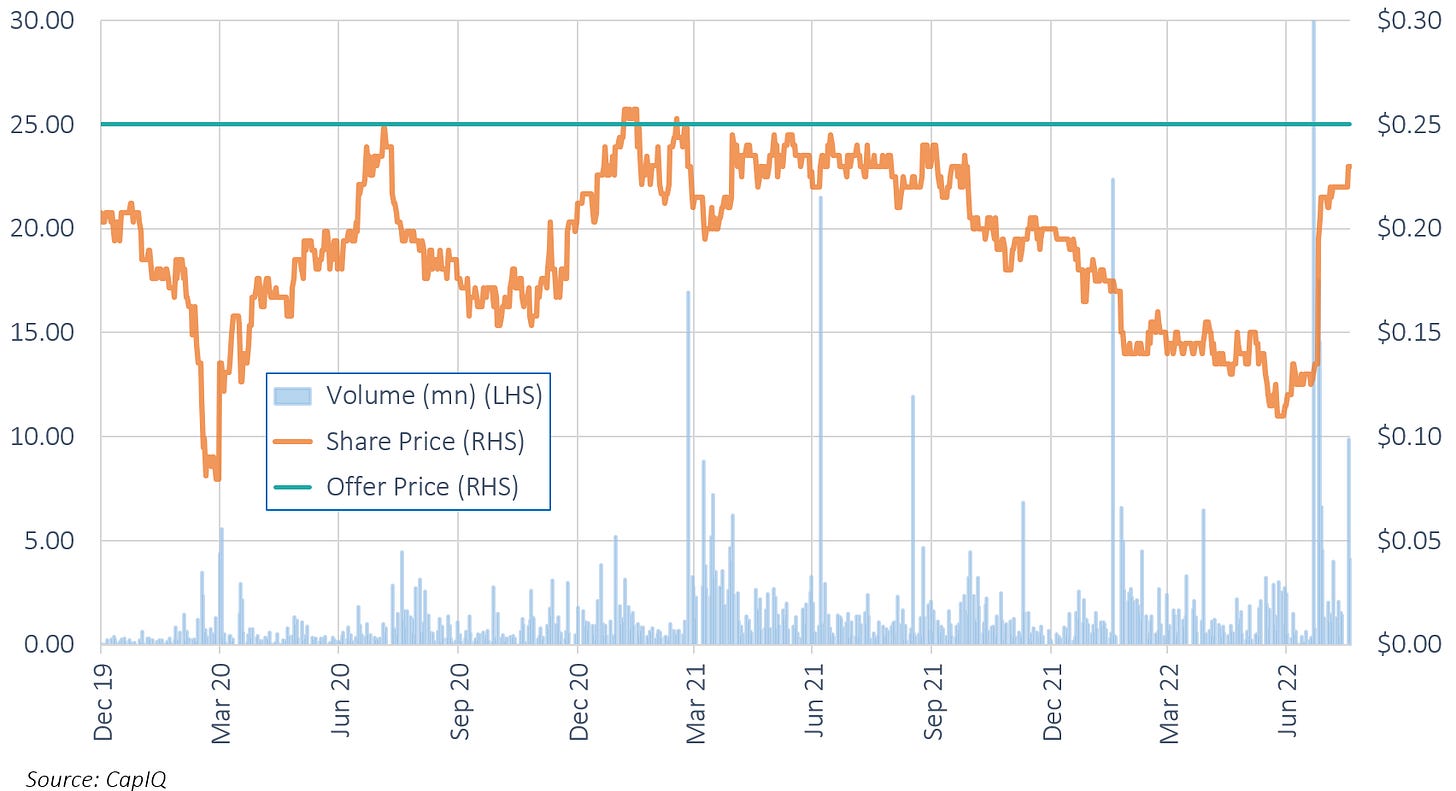

How the Offer Price Stacks Up

The Offer Price is a ~85% premium to last close, well in excess of what you would typically see in Aussie deals in the past.

Skip Essential Infrastructure Fund

Skip is controlled by Atlassian billionaire Scott Farquhar. His wife Kim Jackson heads up Skip.

Along with Mike Cannon-Brookes, Farquhar is the co-founder and co-CEO of Atlassian, who has recently been on the news in his bid for AGL Energy Ltd (AGL AU).

In March last year, Genex sought A$90mn as part funding for the $777mn Kidstong hydro development.

Reportedly Mike Cannon-Brookes and Scott Farquhar substantially contributed, paying A$0.20/share.

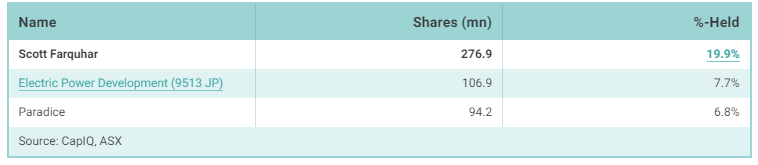

Shareholder Register

Electric Power Development C (9513 JP) became a substantial shareholder on the 18 May 2021, paying A$0.20/share.

EPD, operating as J-Power, signed an agreement with Genex in May of this year to co-develop up to 200-MW of wind power in Queensland.

Paradice reduced its stake to 6.8% on the 22 April this year.

Timing?

Nothing specific here, but with limited DD - Farquhar holds a 19.9% stake - you may see a firm Offer in 2-4 weeks.

Then bolt on another ~4 months for completion.

Conclusion

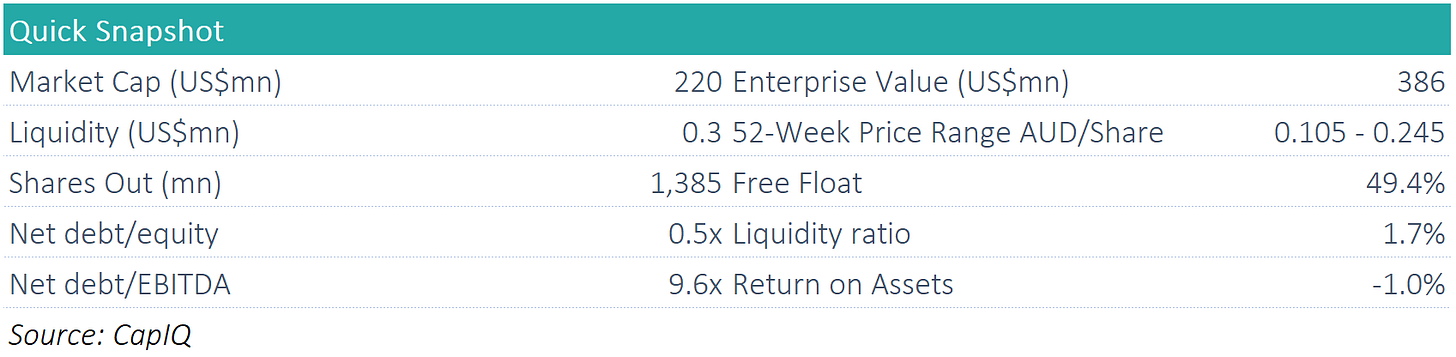

Pricing is fair. It has not traded through terms today.

If a firm price emerges at A$0.25/share, Genex's board’s current intention is to unanimously recommend that Genex shareholders vote in favour of the Proposed Scheme.

This is done. Farquhar knows this company and should shortly firm up his proposal.

The Trade:

Trading around an 8.7% gross spread to the indicative Offer.

This is a buy here. But is not a super liquid arb situation.

About Genex

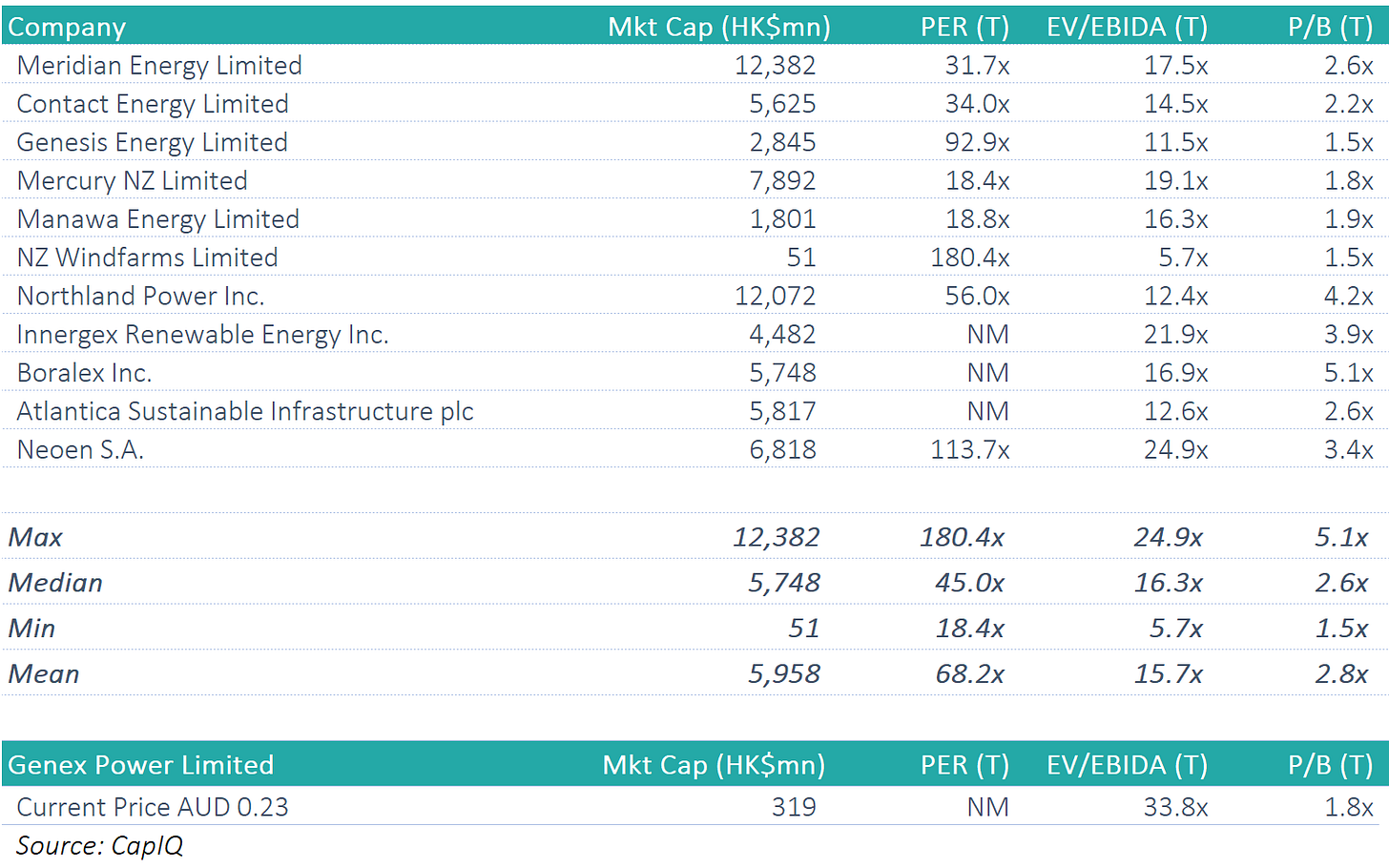

Peer Comparison

These peers are lifted from Tilt Renewables Ltd (TLT NZ)'s Scheme Booklet.

Tilt which had a market capitalisation of NZ$3,070mn, and an enterprise value of NZ$3,268mn, was taken out a forward multiple of 28x EV/EBITDA.

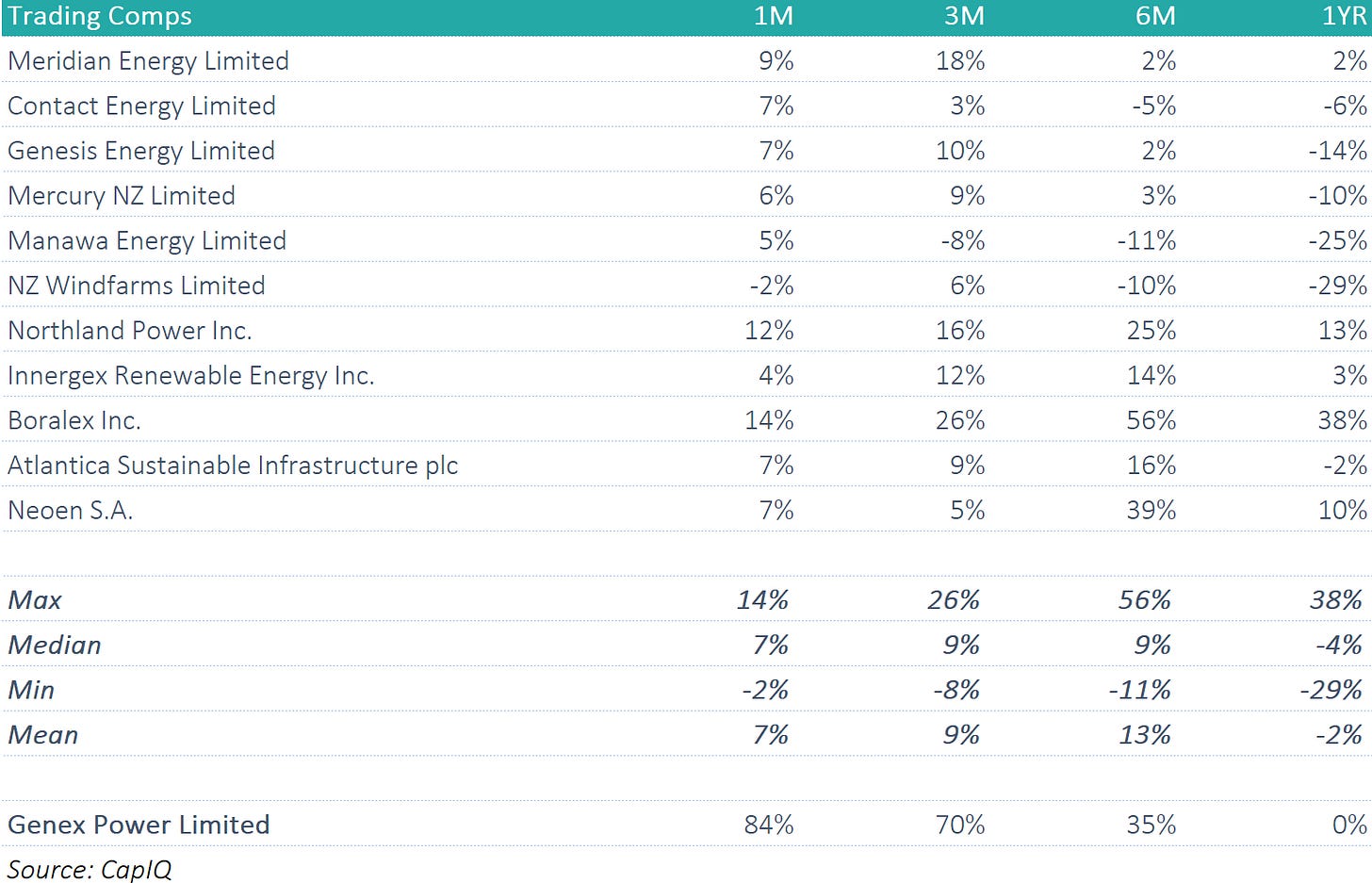

Price Performance

Optically, the Offer still appears a little opportunistic.

Share Price Performance Vs. Peers

Genex has slightly underperformed peers over the last year.