Gina Can't "Liontown" SQM's Bid For Azure

When lithium mining play Azure Minerals (AZS AU) was halted this week "regarding a potential change of control transaction", Sociedad Quimica y Minera (SQM/B CI) was the obvious suitor.

This was confirmed this morning with a A$3.52/share Offer, a 44.3% premium to undisturbed, by way of a Scheme. A concurrent conditional off-market takeover at A$3.50/share is also present.

$3.50 is locked in, no matter what. Gina may take her stake up to 19.9%, but it won't affect the A$3.50 floor. But it may kickstart a competitive bidding situation.

Conclusions First

The Offer premium is well within the range of expectations.

The two-pronged approach, Scheme then off-market Offer - should the Scheme fail - sets a clean floor going forward at A$3.50/share.

The Scheme conditions include no other shareholder apart from SQM holding more than 19%.

That condition appears to specifically target Gina Rinehart who scuppered Albemarle Corp (ALB US) tilt for Liontown Resources (LTR AU) after building a 19.9% stake. And to the best of my knowledge, her intentions for Liontown are still not known.

Reportedly Gina has ~3-4% in Azure and is seeking upward of 10%. A chunk of the register changed hands via Euroz at $3.50/share today.

Perhaps she is angling for a board seat, or a seat at the negotiation table. Who knows.

Iron ore projects - Gina's bread and butter - are done on a massive scale. Being a minnow is not her MO. So corralling exposure/ownership/control over various lithium mines does make sense.

The dual Offer approach may also address Mark Creasy's 13.2% stake. The SID stands out for what is not present - the complete absence of his name.

Another mining player Chris Ellison allegedly has a minority stake in Azure, and could also prove problematic in the Scheme vote.

The Trade.

Trading tight at A$3.49/share.

If you think this transaction turns hostile, get involved here.

The Deal

The terms. By way of a Scheme, SQM is offering A$3.52/share.

This is a 44.3% premium to last close, a 52.4% premium to SQM's last Offer, and a 46.7% premium to the last equity placement, and a life-time high share price.

Takeover premiums in Australia in recent years are typically inked at ~35%. The average this year has been closer to 40%.

In the lithium space, Codelco recently offered Lithium Power International (LPI AU) shareholders A$0.57/share, a whopping 119% premium to last close. The premium was 44.9% for Essential Metals (ESS AU); and 96% for Liontown Resources (LTR AU) (now abandoned).

Off-market Offer. A simultaneous conditional off-market takeover Offer for a cash amount of $3.50/share, should the Scheme not be successful.

SQM? SQM became a substantial shareholder of Azure on the 10 March this year, with 19.99%.

SQM is seeking investments outside of Chile after the government announced in April this year that it would take controlling interest in all projects through a public company that would partner with private mining firms.

SQM approached Azure with a $2.31/share Offer in August this year but was rejected.

Conditions for the Scheme. Regulatory approvals (including FIRB), and approval from Azure's shareholders, by way of a Scheme, therefore 75% voting FOR. Azure's board is unanimously supportive.

I've not aware of any regulatory pushback.

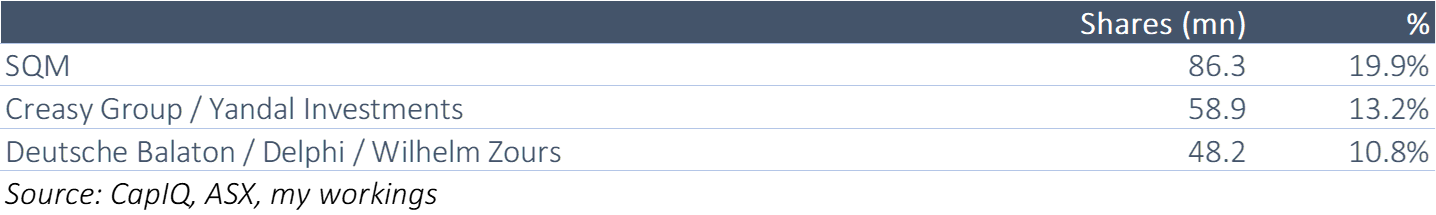

Key shareholder support. Delphi Group (Wilhelm Zours' vehicle) is supportive of the transaction, in the absence of a superior Offer.

Zours became a substantial shareholder (7.2% at the time) on the 3 March 2018.

Last year, Genesis Minerals (GMD AU) launched an Offer for Dacian Gold Ltd (DCN AU) but was thwarted by Kin Mining Nl (KIN AU) and entities linked to Zours.

Creasy? Mark Creasy directly owns 40% of the Andover lithium joint venture project, Azure's flagship project; plus 13.2% of shares out.

His name is not mentioned throughout the entire SID. Which I find odd. Perhaps that's why an off-market Offer is present.

Anything else?

The Scheme is also conditional on no shareholder, other than SQM, acquiring greater than a 19% interest in Azure.

Off-market Offer Conditions. The Scheme has to have failed.

There will be no minimum acceptance condition.

The Offer period will be for 20 business days after the Scheme Meeting.

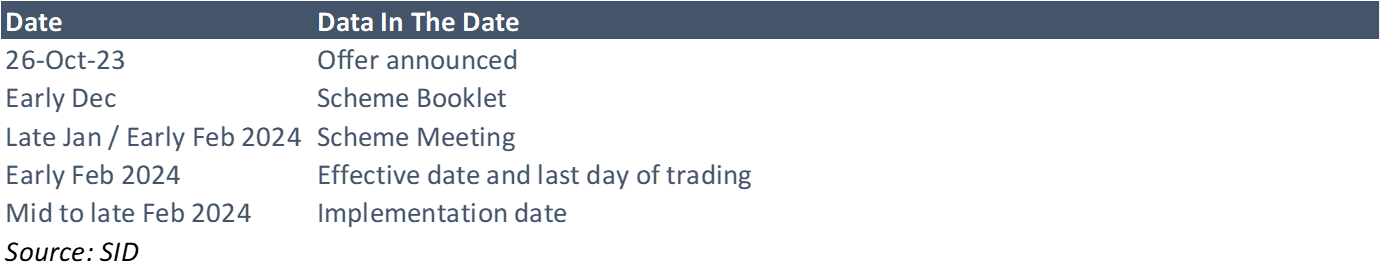

Timing. According to the announcement, the Scheme Meeting is expected to be held late January 2024, early February, with an implementation date mid-late February.

Dividends? Azure doesn't pay dividends.

On Azure Minerals

Azure's flagship project is the 60%-held Andover lithium joint venture project, with mining entrepreneur Mark Creasy (“Creasy Group”) owning the remaining 40% of the project.

Andover is a globally significant lithium exploration project and is also host to two nickel-copper-cobalt deposits.

The maiden mineral resource estimate is expected in the 1Q24; and a scoping study in 4Q24.

Azure also holds 70% interests in the Turner River and Coongan Lithium and Gold Projects in the northern and eastern Pilbara, with the Creasy Group holding the balance, and 100%-ownership of the Barton Gold Project.

Barton comprises four granted Exploration Licences and four Exploration Licence Applications that in total cover 888km2 . The Project is situated adjacent to the historical gold mining town of Kookynie, located approximately 40km south of Leonora in the Eastern Goldfields region of Western Australia.

Azure is currently generating no revenue.

Here is the latest ppt presentation and here is the FY23 (June Y/E) accounts.

Shareholder Register

SQM became a substantial shareholder on the 10 March this year, with 19.99%.

Mark Creasy's Creasy Group has been on the register since 3Q04.

As above, Creasy hold a 40% stake in the Andover lithium project.

Wilhelm Zours became a substantial shareholder (7.2% at the time) on the 3 March 2018.

Share Price Performance

The share price took off in June of this year.

Anything else?

Just 166k shares are short in Azure, as at 20 October