InvoCare: Shareholder Vote On 31st Oct. IE Says Fair

On 9 August, PE outfit TPG and InvoCare (IVC AU), Australia's leading funeral services provider, entered into a Scheme Implementation Agreement at A$12.70/share, inclusive of a A$0.60/share fully franked dividend.

TPG's had previously tabled A$12.65/share on the 7 March, which InvoCare summarily rejected.

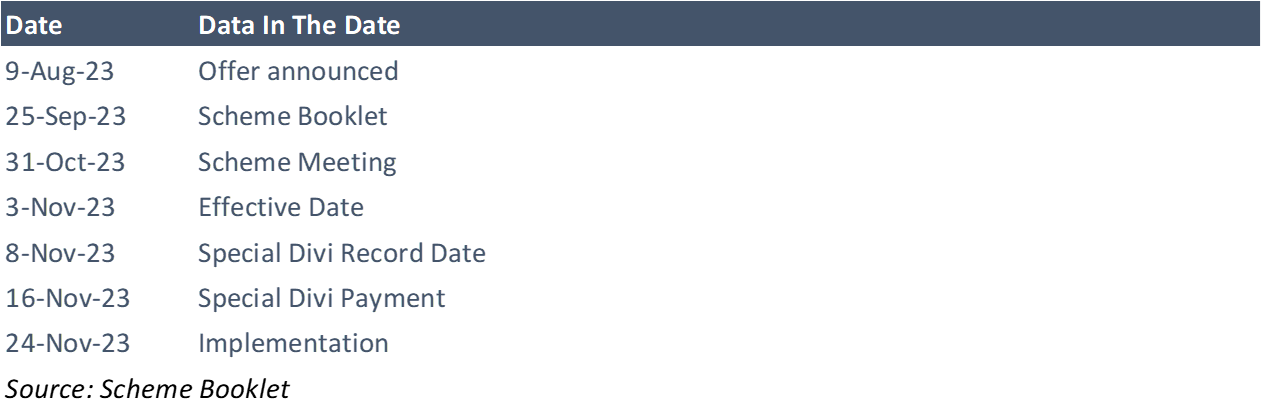

The Scheme Booklet is now out. InvoCare shareholders vote on the transaction on the 31 October, with implementation on the 24 November. The IE says terms are "fair and reasonable".

Conclusions First

After a couple of false starts, this transaction is done and trading accordingly.

InvoCare's Board unanimously recommends shareholders vote in favour of the Scheme.

Currently at a 1%/5.9% gross/annualised spread. Or 2.9%/19.3% for those who can take full advantage of the franking credits.

With the risk-free rate >4%, this is tight.

Stay in for those who got in early. Or enter on any material dips.

The NEW News

The Scheme Booklet has been lodged with ASIC.

The Scheme Meeting will be held on the 31 October, with implementation (payment) on or before the 24 November.

The record date for the special dividend is the 8 November. Payment is the 16 November.

The IE opinion. Kroll's (the IE) report begins on page 141 (of the PDF), and runs for a respectable 92 pages.

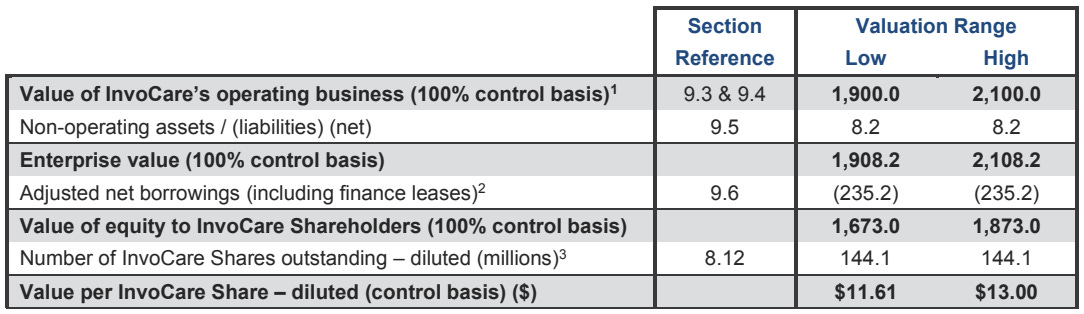

Kroll backed out a fair value range of A$11.61-13.00/share - see page 148 (of the PDF), with estimates based primarily on DCF.

Precedents. There are very few recent transactions involving deathcare companies.

The multiples for those transactions are in the range of 11.8 to 25.7 times first forecast year EBITDA - see page 208 (of the PDF) & page 231.

Invocare's implied forward EV/EBITDA ranges from 13.9x-15.2x - see page 205.

Comparable company analysis can be found on page 228 (of the PDF).

Kroll reckons the terms are fair and reasonable.

Recap Of Terms

The terms. InvoCare shareholders will receive $12.70/share in cash, inclusive of a fully franked special dividend of up to $0.60/ share

This is a 42% premium to undisturbed.

Eligible shareholders may benefit from franking credits of ~A$0.25/share (1/0.7 x 0.60 - 0.60).

An unlisted scrip option alternative for shareholders who elect to roll over a portion of their shareholding into an unlisted equity in the privatised InvoCare is available, if at least 5% of InvoCare's share register opts for scrip.

A scaleback mechanism would then be put in place to cap InvoCare shareholders having more than 20% in the unlisted vehicle.

Conditions. Stock standard InvoCare's shareholder approval, FIRB, and New Zealand's OIO.

The OLD News

On the 7 March, TPG secured a 17.8% stake in InvoCare, and also pitched a A$12.65/share non-binding indicative Offer via a Scheme.

On the 27 March, the Board of InvoCare unanimously concluded that the Indicative Proposal from TPG "does not provide compelling value ... has informed TPG that it is not prepared to grant full due diligence access."

However, InvoCare has offered to provide access to limited, non-public financial information on a non-exclusive basis.

On the 24 April, TPG withdrew its non-indicative proposal.

On the 15 May, TPG returned with a revised A$13/share, inclusive of a A$0.60/share fully franked dividend.

If the proposal became a binding transaction, InvoCare's Board intends to unanimously recommend it.

On the 19 June, TPG's exclusive DD was extended until the 3 July. Then And now extended to the 10 July. Then to 17 July. And on the 18 July, InvoCare simply said it was continuing to work with TPG towards entry into a Scheme.

On 9 August, TPG and InvoCare entered into a Scheme Implementation Agreement.

On InvoCare

InvoCare is a leading provider of funeral services in Australia, New Zealand, and Singapore, and operates private memorial parks and crematoria in Australia and New Zealand.

It is also a leading provider of pet cremation services in Australia.

InvoCare was listed on the ASX in 2003 at an IPO price of $1.85.

Recent results. InvoCare said on the 9 August it expects its 1H23 EBITDA to decline >10% yoy in the wake of a comparatively benign flu season.

Those numbers were out on the 28 August.

Shareholder Register

Apart from TPG, Kuang Ming (a Singaporean-based investor) holds 6.06%.

Its first substantial shareholding announcement was the 27 April 2021, when shares were trading ~A$11/share.

Vanguard did hold 5.01% at the time the Scheme Booklet was prepared.

Vanguard ceased being a substantial shareholder on the 15 September - the announcement was made on the 21 September.

Versus Peers

On all metrics, InvoCare's current valuation looks full versus peers (lifted from the IE report).

InvoCare's five-year average EV/EBITDA is 16.6x versus 18.9x now.

Price Performance

Optically, the price looks okay.

InvoCare has generally outperformed peers over the past year.