PointsBet (PBH AU): Either Betr Pulls A Rabbit Out Of The Hat, Or Walks

Mixi (2121 JP)'s A$1.20/share cash Offer is now open, with a 50.1% acceptance condition. PointsBet Holdings (PBH AU) is supportive. Mixi currently holds 25.15%. ~16% of shares out have tendered.

Betr Entertainment (BBT AU) (self-alleged superior) scrip Offer, with no minimum acceptance condition, is still out there. betr holds 19.6%. No shareholder has accepted terms.

PBH has now tapped the Takeover Panel seeking orders betr clarify its convoluted Offer.

PointsBet is an illiquid stock. If that's not your bag, look away now.

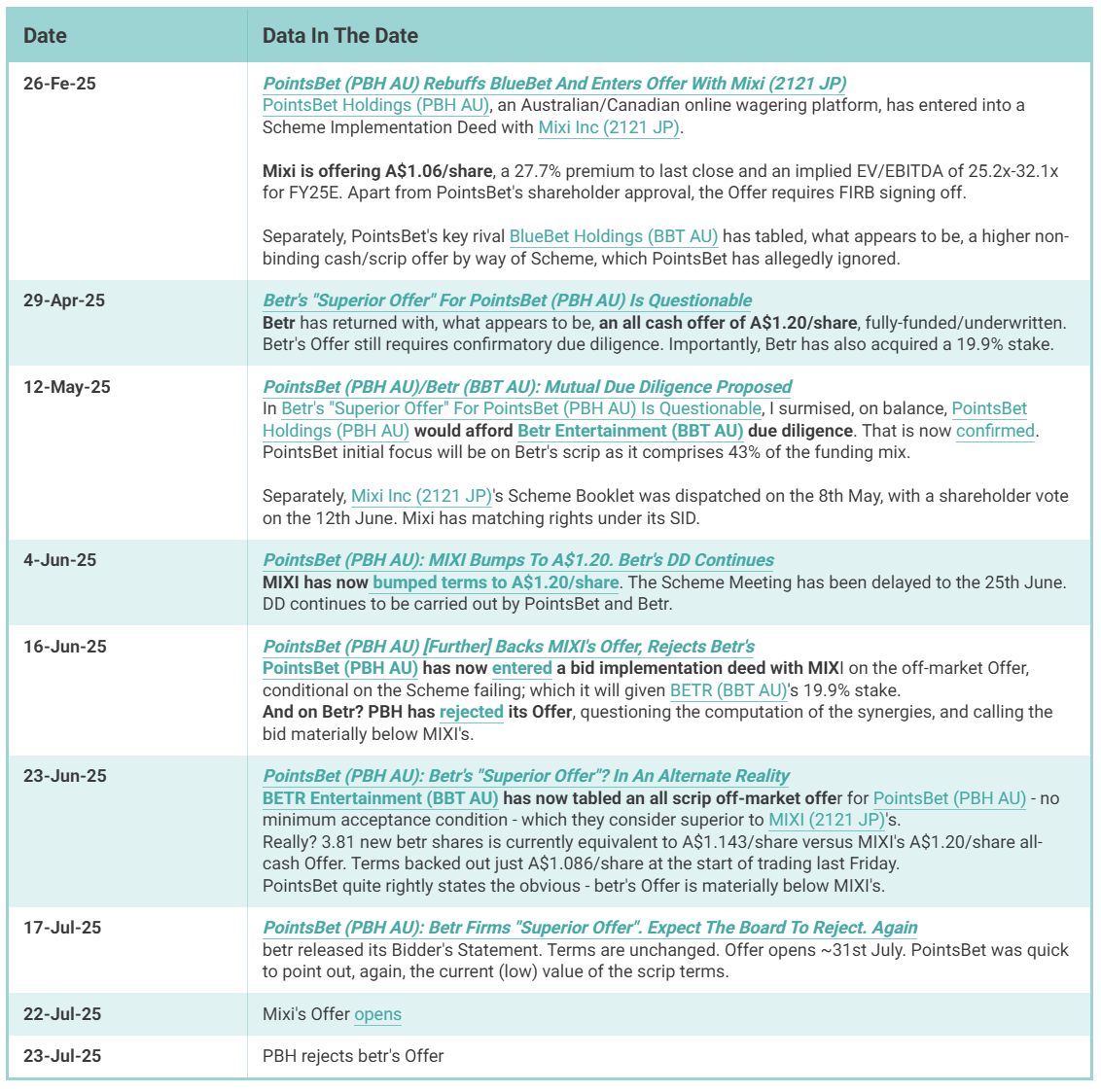

MIXI's initial Offer, by way of a Scheme, was on the 26th Feb. betr's approach was rejected.

I've followed with six subsequent reports as betr attempted to dislodge MIXI.

What's New?

Mixi now holds 25.15%, including 0.67% in an acceptance facility.

It's not clear if this includes 8.02% held by PBH shareholders, as announced on the 22nd July, who are expected to tender within ten business days from the Offer opening on the 22nd July.

The Takeovers Panel. PBH raises the following issues:

1. the value of the consideration offered under the betr offer, is “presented in a highly misleading and unbalanced way";

2. the synergies which betr relies upon in valuing its offer consideration, which it submits “contain material errors and are presented in a misleading, incomplete and unbalanced manner”;

3. by promoting a selective buy-back of betr shares following the closure of the takeover offer at $1.22/share, betr is seeking “in effect to offer PointsBet shareholders a cash alternative to the all-scrip offer” which is being offered outside the betr offer and represents “a clear inducement to encourage acceptance”;

4. betr has breached the policy behind the minimum bid price rule in section 621(3) by inflating Betr’s share price through announcing details of the selective buy-back;

5. betr’s Executive Chairman, Matthew Tripp, has failed to disclose the true extent of his and his associates’ voting power in betr.

Keep reading with a 7-day free trial

Subscribe to Aussie/Kiwi M&A/Events to keep reading this post and get 7 days of free access to the full post archives.