Quiddity Australia M&A Guide 2019

This is part of a series of M&A guides that our Quiddity* team (see our profiles or the footnote below) are publishing to aid investors in understanding the rules, parameters, possibilities, and processes when companies conduct mergers and acquisitions. These insights are designed to be used as a reference.

Governing Law for M&A

The key set of rules and regulations governing the mergers and acquisitions of public companies in Australia are listed below:

Corporations Act 2001

Australian Stock Exchange Listing Rules (ASX Listing Rules)

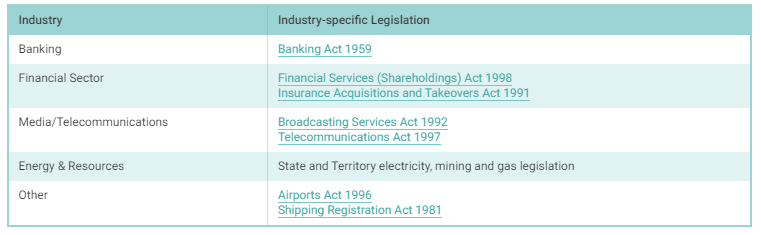

In addition to the rules and regulations mentioned in the Laws and Rules noted above, anti-competitive practices are regulated by the Competition and Consumer Act 2010 and certain industries have industry-specific legislation which can impose restrictions on takeovers involving companies falling under those sectors as highlighted in the table below.

Examples for Industry-specific Legislation in Australia

The main regulatory bodies responsible for the oversight of M&A in Australia are listed below:

M&A Transactions in Australia

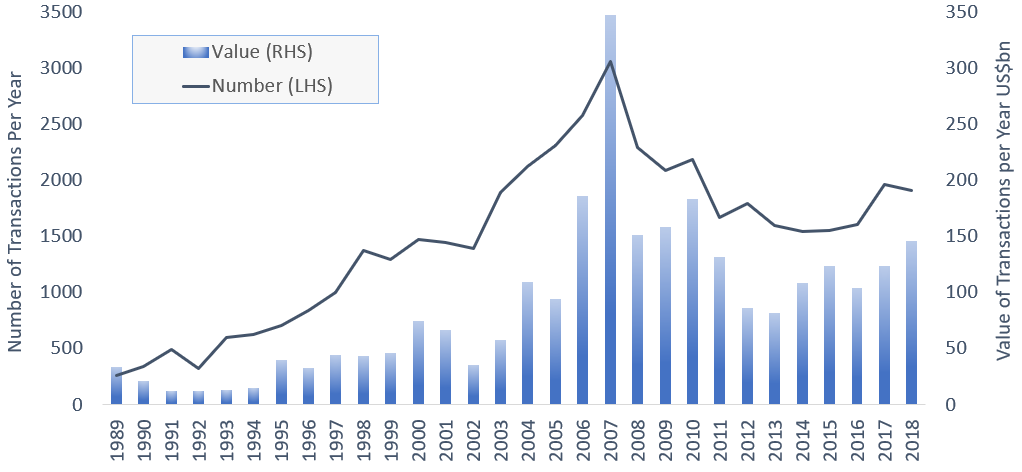

M&A transactions have continued to grow in size since 2013 with last year but still less than half the peak value pre-GFC.

Source: Acquisitions and Alliances (IMAA) analysis

Keep reading with a 7-day free trial

Subscribe to Aussie/Kiwi M&A/Events to keep reading this post and get 7 days of free access to the full post archives.