QV Equities (QVE AU): 28th June Shareholder Vote

On the 12th March, Aussie-based investment plays QV Equities Ltd (QVE AU) and WAM Leaders Ltd (WLE AU) entered into a Scheme.

The current scrip terms are 0.739 new WAM shares per QVE share; OR A$0.989/share cash. Terms will be adjusted for updated pre-tax NTA/shares of both companies after the Scheme Meeting.

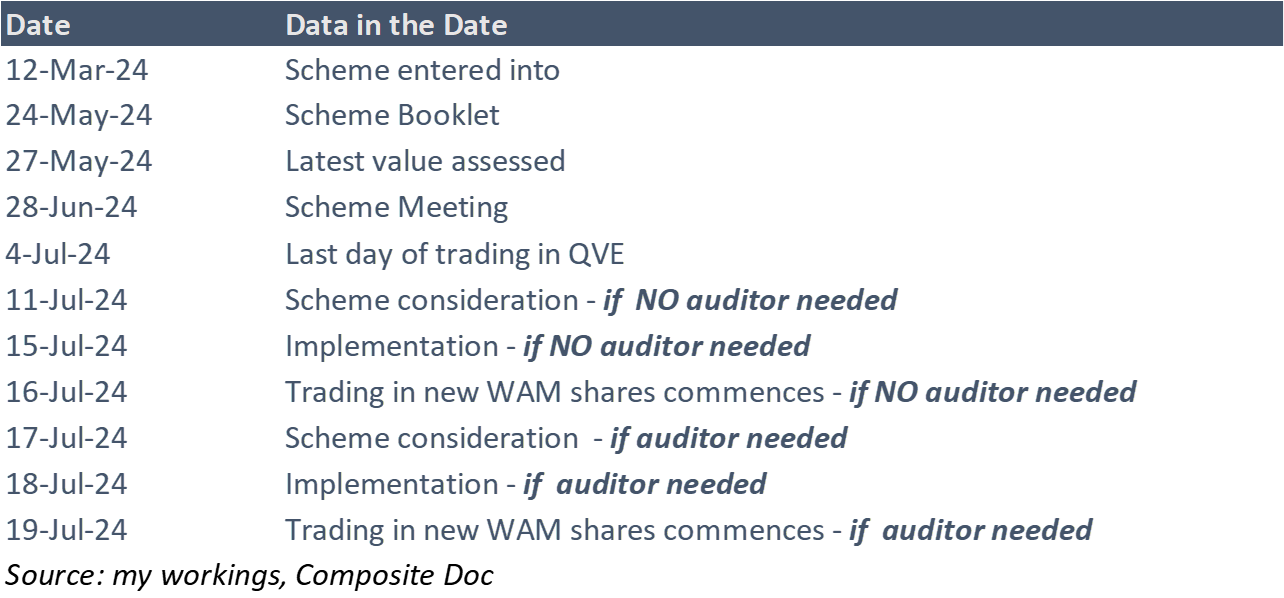

The Scheme Booklet is now out, with a Scheme Meeting to be held on the 28th June. Expected implementation on the 15 July. The IE says fair & reasonable.

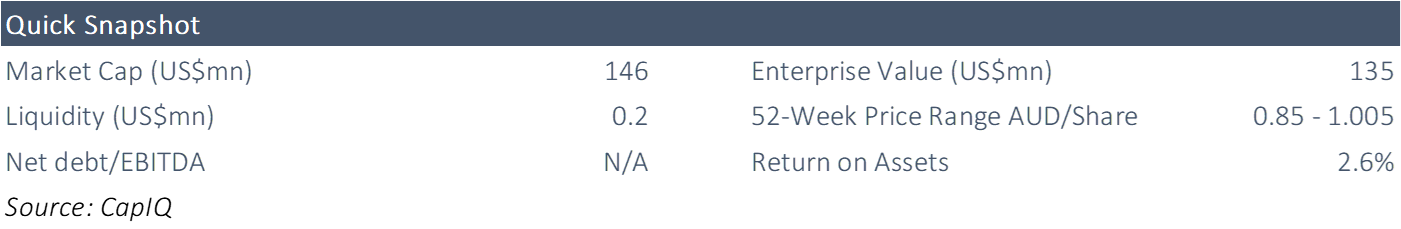

Both QVE and WAM are illiquid - look away now if this is not your bag.

Conclusions First

The actual Scheme Consideration will be calculated using the pre-tax NTA of QVE and WAM Leaders on the 4 July - otherwise known as the Calculation Date in the Scheme Booklet - and is expected to be announced a week later (11th July). IF both parties agree the pre-tax NTA amounts (and auditor confirmation is not required).

Therefore, the Scheme Consideration will not be known until immediately before the Scheme is implemented.

QVE has released worked examples of the Consideration, the latest released yesterday, the 27th May.

A further worked example will be announced on the 21 June, one week before the Scheme Meeting, based on the 31 May 2024 pre-tax NTAs for both companies.

Applying the most recent financials for both, QVE shares are worth up to $1.035 each based on the scrip calcs; and $0.989/share for the cash option, after a 2.5% discount is applied to QVE's pre-tax NTA/share.

A merger of these two companies makes a lot of sense: access to a larger market cap; increased liquidity; and higher franked dividends.

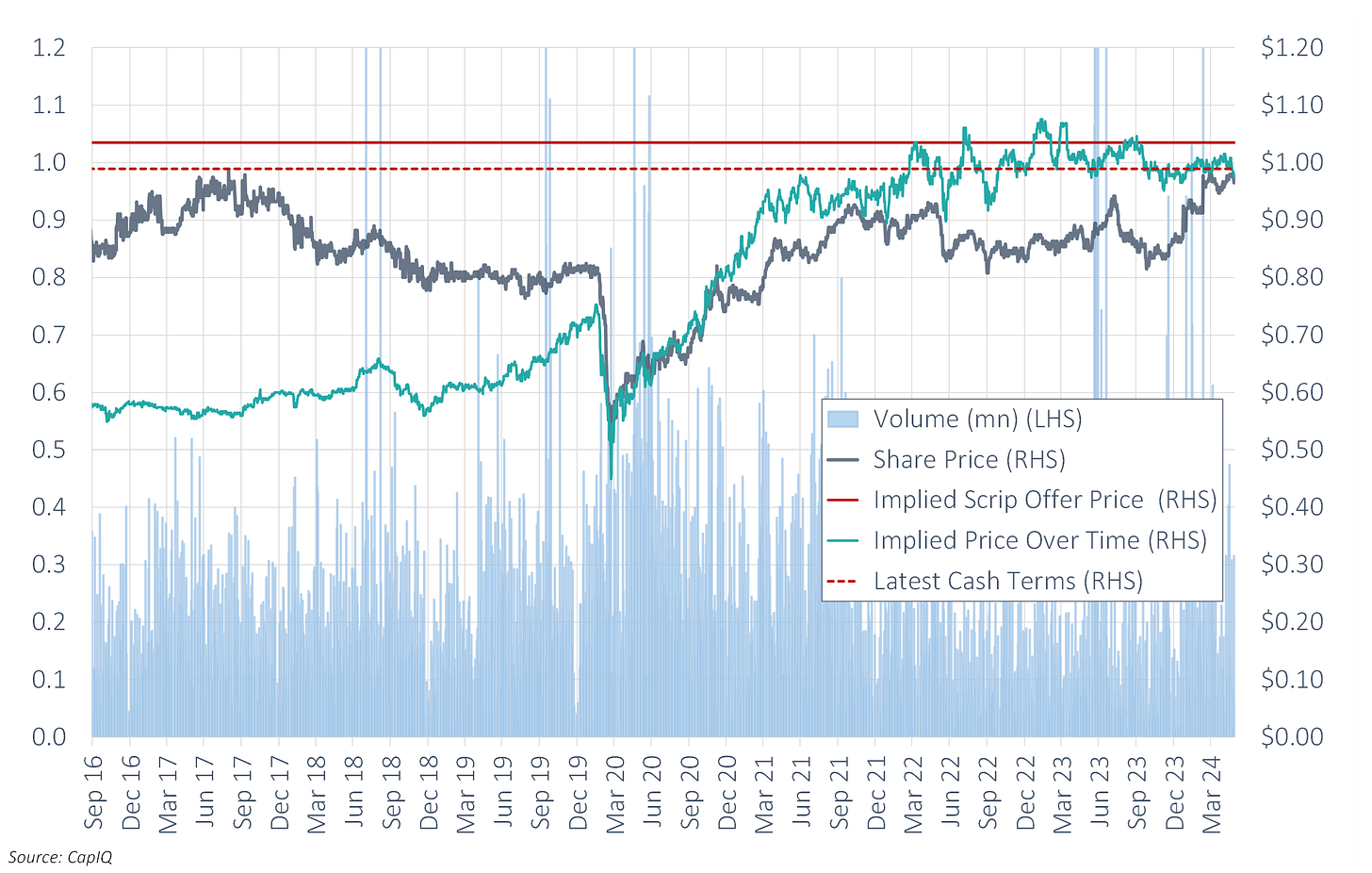

The implied cash Offer Price is pitched around a multi-year high.

WAM’s associated entity, WAM Strategic Value (WAR AU), holds 15.76% of the issued QVE Shares. This stake arguably reduces the likelihood of a competing Offer.

The Trade:

Currently trading at a gross/annualised return to the cash terms of 2.5%/20%, assuming payment mid-July. Not bad. Assuming cash terms remain unchanged.

Alternatively, IF you can take down borrow cheaply on WAM, look to go long QVE, short WAM here.

The NEW News

The Scheme Booklet has been registered with ASIC, and officially distributed this afternoon (28th May).

The Scheme Meeting will be held on the 28th June, with (expected) implementation on the 15th July, if no auditor needed. New WAM shares will commence trading on the 16 July.

The full timetable is on pages 10-11 (of the PDF).

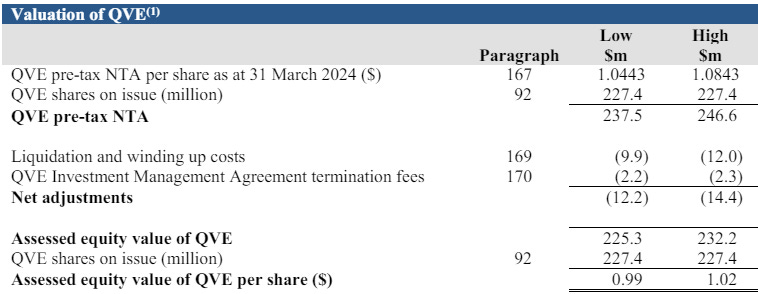

The Independent Expert (IE) opinion. Lonergan Edwards' (the IE) report begins on page 130 (of the PDF).

As often seen in Scheme docs Down Under, this 79-page report is a solid read of QVE and its industry.

Lonergan Edwards backed out a fair value range for QVE of A$0.99-A$1.02/share - having regard to QVE's NTA, with some minor adjustments.

Additionally, Lonergan Edwards estimates the scrip consideration to be A$0.03/share above its assessed value for QVE.

Lonergan Edwards flagged six comparable companies on page 175 (of the PDF), and noted that acquirers generally do not pay a premium over and above the underlying NAV.

Lonergan Edwards concluded that the Scheme is in the best interests of shareholders; in the absence of a superior proposal.

Recap Of The Transaction - Based On Latest Working Example

Do read this ASX announcement from the 27th May, which goes through the necessary workings for both the scrip and cash option.

Scrip Terms. The consideration under the Offer is, using 31 March NTA figures for both QVE and WAM, is 0.739 new WAM shares per QVE share. Or an implied price of A$1.035/share.

That's a 14.4% premium to undisturbed.

I estimate current QVE shareholders will hold ~11.8% in the MergeCo if all shareholders elect scrip.

Cash terms. This will be a 2.5% discount to QVE’s pre-tax NTA per share, or $0.989/share, using the latest figures.

It was A$1.02/share when the Scheme was entered into.

OR a combination of cash and scrip. Mix & match.

I don't see any scale back on the cash terms; or a min/max scrip condition.

Conditions. Approval from QVE's shareholders (Scheme vote, therefore 75% of present and via proxy giving the thumbs up).

Entities associated with WAM Leaders have a relevant interest in 15.8% of QVE shares on issue. This includes WAM Strategics’ stake.

Dividends? Yes. Sort of.

WAM declared a dividend due to be paid on 31 May (ex-date was the 21st May).

As the record date for this dividend is before the Implementation Date, Scheme Participants were ineligible for this dividend.

On the 26 February, WAM announced dividend guidance for its financial year ending 30 June 2024; and Scheme Participants will be eligible for this dividend.

QVE declares quarterly dividends and declared a dividend for the 2024 March quarter of 1.3 cents on the 24th April. The ex-date was the 14th May.

On QV Equities

QVE portfolio was established in August 2014 and is managed by Investors Mutual.

On WAM Leader

Listed in May 2016, WLE provides investors with exposure to "an active investment process focused on identifying large-cap companies with compelling fundamentals, a robust macroeconomic thematic and a catalyst".

WLE is managed by Wilson Asset Management which is the investment manager for eight LICs (including WLE) - others include WAM Capital Ltd (WAM AU),WAM Global Ltd (WGB AU), WAM Microcap Ltd (WMI AU), WAM Alternative Assets (ASX: WMA), WAM Strategic Value (ASX: WAR), Wam Research (WAX AU) and WAM Active Ltd (WAA AU).

Wilson Asset Management invests over $5bn on behalf of more than 130,000 retail investors.

Valuations

QVE's average trailing P/B over the past five years is ~0.88x versus 0.91x currently.

Share Price Performance

QVE is up on the year; whereas WAM is down. Both trail the ASX.

QVE has recovered from its Covid low but has consistently traded at or below the implied cash Offer price - both scrip and cash.